The Globe and Mail Economy Lab dated March 7, 2011, carried a provocative heading heralding the Loonie no longer a petro-dollar. It cites Marc Chandler's views on the breakdown of CAD correlation with oil prices. Mr. Chandler is the Global Head of Currency Strategy at Brown Brothers Harriman & CO; he knows what he is talking about and taken in isolation, his views are valid.

But we need some context. The point I am trying to make today is that the CAD-Oil relationship has always been thus: beyond $100 per barrel, the correlation of CAD to oil is non existent but beneath it, the relationship remains valid and should be an integral input to anyone's CAD outlook. As a picture is worth a thousand words, let's elucidate this discussion with some charts.

Exhibit 1 shows a time series of USDCAD against the 1 month future price of crude (January 1, 1990 - March 7, 2011)

Exhibit 1

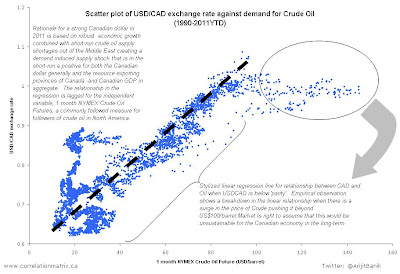

Exhibit 2 is a scatter plot of USD/CAD against the price of crude with a stylized regression to show the relationship when crude is less than $100 per barrel and above $100 per barrel (where I argue that the relationship breaks down).

Exhibit 2

For the sake of a bit of rigour, here are the regression figures (Exhibit 3 & 4):

For the sake of a bit of rigour, here are the regression figures (Exhibit 3 & 4):The relationship in the regression is lagged for the independent variable, 1 month NYMEX Crude Oil Futures, a commonly followed measure for followers of crude oil in North America.

Exhibit 3: When Oil <= 100/barrel

To add some nuance, here are the regressions since 2000.

Exhibit 5: A stronger CAD - Oil relationship.

Takeaway for CAD for the remainder of 2011.

Over the past fortnight, we have witnessed tensions in the Middle East erupt with a long overdue exercising of democracy in Tunisia and Egypt, and the attempted ousting of a despot, Mohammar Quadaffi, and the subsequent entrenchment of civil war in Libya. Naturally, this has meant uncertainty in the flow of Libya’s sweet crude to Europe – hence the spike in North Sea Brent. WTI, the North American benchmark, has decoupled from Brent but has not been immune to speculation – this has meant a strengthening CAD in the past and is witness today of CAD highs against USD last seen in 2007.

Rationale for a strong Canadian dollar for the remainder of 2011 is based on robust economic growth in the domestic economy – the Bank of Canada is counting on GDP growth to come from business investment and a closing of the output gap by the end of 2012 – combined with short-run crude oil supply shortages out of the Middle East creating a demand induced supply shock that is in the short-run a positive for both the Canadian dollar generally and the resource exporting provinces of Canada – and Canadian GDP in aggregate.

Trees don’t grow to the sky and neither can CAD.

As shown in Exhibits 3-5 when Oil has exceeded USD 100/barrel the relationship breaks down.

Is CAD strength a drag on non resource exports? I believe so. This could be due to greater demand elasticity for manufactured goods; the idea of higher resource costs acting as a tax and reducing consumption in the U.S. when Americans confront $4 a gallon gasoline. Moreover, a persistently stronger CAD makes Canada’s exports uncompetitive which is untenable given the country's long running productivity challenges. But these inputs work their way through to the macroeconomic numbers with a lag. The entry of 2 billion consumers – and their demand for the spoils of Western style consumerism – dispersed amongst the BRICs simply complicate matters.

FX cannot be seen exclusively through the prism of an an equilibrium value – as strict disciples of neo-classical economics are wont to do, hence their advocacy of a random walk – any forecast of a currency pair must take into account short, medium and long term factors. In relation to USD, those short and medium term factors weigh heavily in CAD's favour.

USD remains a safe haven and is viewed as such when the risk off (risk aversion) trade is in favour but… all signs point toward USD weakness in 2011:

- real long term interest rate differentials;

- risk appetite;

- trend following;

- current account deficits;

- ability to reduce FED balance sheet to ward off nascent inflationary pressures;

- a viable and realistic fiscal plan;

- budget challenges at the state and municipal level are negative to USD.

If the United States were any other country then there would have been a massive USD devaluation by now; the strong dollar policy is a convenient fiction and accusing China of currency manipulation – however warranted

– won’t make America’s fiscal challenge disappear.