The opinions reflected below are those of the author.

Summary:

Prologue

Introduction

The Importance of Credit

Concept: The Credit Impulse (by Michael Biggs, Thomas Mayer, and Andreas Pick)

Further reading: The myth of the "Phoenix Miracle" and Credit and Economic Recovery

Concept: The Credit Accelerator (by Steve Keen)

Further reading: Credit Accelerator Leads and Lags; Economic growth, asset markets and the credit accelerator; Updated Credit Accelerators and Dude! Where's My Recovery

The Credit Accelerator (CA) at any point in time is the change in the change in debt over previous year, divided by the GDP figure for that point in time.

A statistical analysis of Keen's CA yielded the following comment:

See the pictures and charts that follow (and click if you wish to enlarge)

Why will rates remain low over the long term?

Deleveraging

At current rate of US savings --and assuming that there is no further relapse in housing or appreciation in market values of residential properties in the United States-- it will take 12 years to deleverage (see Technical Box 1 of the October MPR).

Canadians have taken on debt with financial conditions currently at a positive to neutral level.

Christopher Ragan, "Canada's Looming Fiscal Squeeze," November 2011

(bold emphasis added)

Development

For a nuanced view, where we have the situation of the monetary base being increased greatly, Friedman's aphorism can be true but does not necessarily have to be true. The FED's actions, and those of the Swiss National Bank attest to that: ultimately the FED's action has led to the exporting of inflation to the developing economies (despite the analysis of the San Francisco FED economists who maintain that this has not the case). The combination of a liquidity trap and balance sheet repair domestically, and the search for growth internationally through portfolio capital flows has meant no inflation in the United States but serious asset inflation elsewhere.

But if Freidman's aphorism was meant to mean that "governments printing money create inflation" then the term is undeniably false: inflation --specifically hyperinflation-- is the result of three inter-related factors: (i) increase in money supply of fiat currency combined with (ii) social and political stress often associated with post-war political instability, civil war, or adjusting to defeat as a consequence of war and (iii) weak government.

We have seen that monetary policy has been largely ineffective at the lower bound yet it remains incredibly potent in terms of choking off economic growth due to the sensitivity of Canadians to rate hikes.

Assuming that rates along the trajectory of a business cycle go from 1% to 2.5%, we can observe how debt servicing would increase on a mortgage of an "average" City of Toronto home owner (May 2011 data). The extra 150 bp in rate increases translates to a yearly debt servicing increase of $5,376 dollars on a variable rate mortgage whose principal amount was $535,807.

Wonkish sidebar: I am not subscribing to the New Classical notion of one representative agent as I prefer the analogy of a phase transition where a mass of people do a similar thing and pursue similar options at once due to social pressure. There must be a consequence to social structure that constrians some outcomes and encourages others.

Keep in mind that in the real world, an increase in debt servicing is not isolated; increased commodity prices funnel through to the monthly grocery and fuel bill also: in aggregate, absent a real wage increase and access to further credit to supplement income, this translates to lower consumption.

Key takeaways

Summary:

The main takeaway is that there will be neither a swift nor partially delayed return to rate normalization (a rate that may be defined by the Taylor Rule or its variant) in Canada despite the highly accomodative interest rate environment that should theoretically spur strong growth after the slack in the economy is taken up by pent up demand.

The forecast is for a secular trend of "low rates" (with an upper bound of 2.50%). This long term secular forecast does not entail no growth; it entails below trend growth and the dynamics of a global austerity cycle forming a backdrop against a Canadian demographic trend that will be coincident with government policy attempting to reflate rather than burst asset prices and the related debt that Canadians have undertaken in the absence of real wage growth.

"Low rates" are defined as 20th percentile of median BOC rates of the last 21 years --during which monetary policy became tied to the nominal anchor of core inflation at 2% (+/- 1%); a "normal" rate during this period could be represented by the median rate that has been 4.25%.

We should see low rates as a secular trend ("long term")--with discretion trumping rules as the end of an epoch of profligacy in the developed nations opens the door to a new era of shifting challenges within the Canadian and global economy; this will make the trend growth of the past generation as elusive in Canada as it has been in Japan but it will not mean no growth just lower than trend growth of the last 30 years that has been intensified due to a favourable credit and demographic environment.

The forecast is for a secular trend of "low rates" (with an upper bound of 2.50%). This long term secular forecast does not entail no growth; it entails below trend growth and the dynamics of a global austerity cycle forming a backdrop against a Canadian demographic trend that will be coincident with government policy attempting to reflate rather than burst asset prices and the related debt that Canadians have undertaken in the absence of real wage growth.

"Low rates" are defined as 20th percentile of median BOC rates of the last 21 years --during which monetary policy became tied to the nominal anchor of core inflation at 2% (+/- 1%); a "normal" rate during this period could be represented by the median rate that has been 4.25%.

We should see low rates as a secular trend ("long term")--with discretion trumping rules as the end of an epoch of profligacy in the developed nations opens the door to a new era of shifting challenges within the Canadian and global economy; this will make the trend growth of the past generation as elusive in Canada as it has been in Japan but it will not mean no growth just lower than trend growth of the last 30 years that has been intensified due to a favourable credit and demographic environment.

The Canadian context of a democratic small open economy with a solvent, liquid, protected and highly regulated banking system whose greatest financial risk --a crash in the housing market akin to that in the United States-- is backstopped thanks to the unknowing largess of the Canadian taxpayer does not translate easily to the rest of the developed world that is beholden to zombie banks acting as dead weights to their respective economies and serving no purpose but black holes of capital consumption.

However, the basic framework here --incorporating Development, Debt, Deleveraging, and Demographics-- suggests that demand is driven through multiple sources and the degree to which various economic agents engage in them remains as relevant for the rest of the West as it does for Canada.

Prologue

The most popular posting of this blog has remained the commentary on the importance of and access to credit to spur and maintain growth in a modern developed capitalist economy where credit as money (rather then money as a medium of exchange that is a substitute for barter) remains central to the functioning of the real economy and the means of production.

Rather than a rhetorical flourish based on polemicist dictum the idea behind the importance of credit was influenced by two works: one constructed by orthodox neoclassical means (Biggs, Mayer, and Pick); the other via a model of systems dynamics cross pollinated with economic history (Keen) influenced by sources as diverse as Joseph Schumpeter, Irving Fisher, Augusto Graziani and Hyman Minsky.

Introduction

The Importance of Credit

Concept: The Credit Impulse (by Michael Biggs, Thomas Mayer, and Andreas Pick)

Further reading: The myth of the "Phoenix Miracle" and Credit and Economic Recovery

GDP growth is a function of both the change in the flow of credit (second derivative aka "credit impulse") and the change in the stock of credit (first derivative aka "credit growth"). Recalling university calculus this entails that if credit change is stable then the credit impulse is zero but if the change in credit growth is volatile then the credit impulse is large. The authors stress that GDP growth should be viewed as functions of the change in new debt and they emphasize the role of private credit (as opposed to government).

Wonkish sidebar: The credit impulse is based on the first difference of flow series (normalized by GDP) from the Fed Flow of Funds (i.e., F tables). The change in credit stock is based on the level of the credit stocks (i.e., L tables) (divided by GDP deflator).

Concept: The Credit Accelerator (by Steve Keen)

Further reading: Credit Accelerator Leads and Lags; Economic growth, asset markets and the credit accelerator; Updated Credit Accelerators and Dude! Where's My Recovery

The Credit Accelerator (CA) at any point in time is the change in the change in debt over previous year, divided by the GDP figure for that point in time.

Wonkish sidebar: There are three legs to Keen's argument:

(i) The main constraint facing capitalist economies is not supply, but demand as capitalist economies exhibit excess labour, excess productive capacity and generate a much higher rate of innovation than socialist economies.

(ii) All demand is monetary with two sources: incomes and the change in debt; AD = AS + Δ D

(iii) Aggregate Demand is expended not merely on new goods and services, but also on net sales of existing assets asserting the inaccuracy of Walras' Law and asserting Income + Δ debt = Output + Net Asset Sales

Rate of change of asset prices is related to the acceleration of debt

(N.B. This is not an equality) This entails a positive feedback loop between these two variables.

The key result is that there are statistically significant relationships between CA and economic variables, suggesting the importance of private credit in the real economy and the non-neutrality of money in the short to medium term (10 to 20 years). However, the causality of credit appears complex, not displaying the simple time-invariant causality of physics. As Steve's analysis suggests in a complex system where there are nonlinear feedbacks rather than linear causation one expects leads and lags to alter over time

In contrast to orthodoxy the pretext here is that money is neither neutral nor is debt-deflation entails a redistribution from debtors to creditors in the economy in aggregate; for the neoclassical view you would accept Ben Bernanke's rejoinder to the late Irving Fisher's theory as described in The Economist.

Credit in the real world

In the real world of fractional reserve banking, banks create credit out of thin air: the banking system extends credit to businesses; businesses employ labour; labour is paid and their wages ("savings") are then placed into the banking system who lend out further based on a fractional reserve system while businesses and consumer are able to borrow further and must service debt as a result . Of course, this simplified line of thinking is heretical to the orthodox view where savings are the starting point and reserves lead to deposits. As the late Alan R. Holmes (former Executive Director and Senior V.P at the New York Federal Reserve) stated in Operational Constraints on the Stabilization of Money Supply Growth :

The idea of a regular injection of reserves-in some approaches at least-also suffers from a naive assumption that the banking system only expands loans after the System (or market factors) have put reserves in the banking system. In the real world, banks extend credit, creating deposits in the process, and look for the reserves later. The question then becomes one of whether and how the Federal Reserve will accommodate the demand for reserves. In the very short run, the Federal Reserve has little or no choice about accommodating that demand; over time, its influence can obviously be felt.

(bold emphasis added)

Credit in the Canadian context

Building upon the importance of credit we now go to the stylized representation of the Canadian economy. Some points to ponder when viewing the graphic:

- The GDP national accounts have been included to provide readers familiarity with the standard aggregate demand relationship however the building blocks of policy --in terms of financial, government, and business sectors-- have also been included to help consider that political consideration and ideology weigh heavily upon ultimate policy. Rather than the standard national accounting identity, the intent for this stylized representation is for it to be fitted to a stock-flow consistent model (like those of Wynne Godley) or dynamic model that is used in systems dynamics with the fundamental difference in the approaches being the use of discrete rather than continuous time treatment.

- The role of credit provided by the banking sector has helped drive the increase in household indebtedness and driven consumption especially in light of stagnant real wage growth for all but the upper percentiles of wage earners

- The unsustainable rise in residential property prices in Canada has been driven (in the urban areas of Vancouver and Toronto especially where condominium developments continue to mushroom) by a combination of foreign funds from the developing world (particularly China and Russia) and the access to mortgage credit that dwarfs the disposable income of the majority of Canadians. The price trajectory of single family dwellings in major Canadian cities (shown below) is proof that a picture says a thousand words.

- The nebulous output gap remains (officially) the driver of monetary policy looking forward barring an explicit change in methodology by the BOC --see any Bank of Canada Monetary Policy Report-- while your scribe contends that the practical driver of policy remains the first and second derivative of the change in wages (i.e. "wage push inflation") culminating in the movement of core inflation.

- While this stylized version has nothing to do with the Bank of Canada's DSGE model, TOTEM2 (an update to its original Terms of Trade Economic Model) the contention here is that going forward there will be far less volatility in the Bank of Canada overnight rate as the sensitivity of inflation to macroeconomic shocks --a mainstay of orthodox analysis-- is minimal due to the lack of pass through related to higher wages ("second round effects"); this translates to the majority of Canadian workers' wages not keeping up with the cost of living

- The standard argument that growth in real wages are tied to growth in productivity does not hold up to the data: the median real earnings of Canadians hardly budged between 1980 and 2005 while labour productivity rose by 37.4% over the same period: Sharp, Arsenault, and Harrison state that divergence can be explained by four factors: measurement issues associated with wages, an increase in earnings inequality, a decline in labour’s terms of trade, and a decline in labour’s share of national income.

- Monetary policy transmits more quickly to the market rates provided by the non bank financials and the shadow banking sector (in an "exogenous" manner) while meaningful credit creation to the consumer sector remains tied to the more highly regulated and scrutinized banking sector (credit is thus created "endogenously" within an economy).

- The potential losses of any housing correction has been backstopped ex-ante by the largess of the Canadian taxpayer in the guise of the CMHC despite that government agency's well intentioned enterprise risk management framework; the profits will be privatized by the developers, those early to entry and early to exit, and those with built up equity over many years that can weather a correction with their net worth taking a minor rather then brutal hit --while the losses have already been socialized and will be socialized further in the event of a US style housing correction. Ultimately consumption falls in lock step with labour income and many years are required to make up for the loss in equity of a marginal correction.

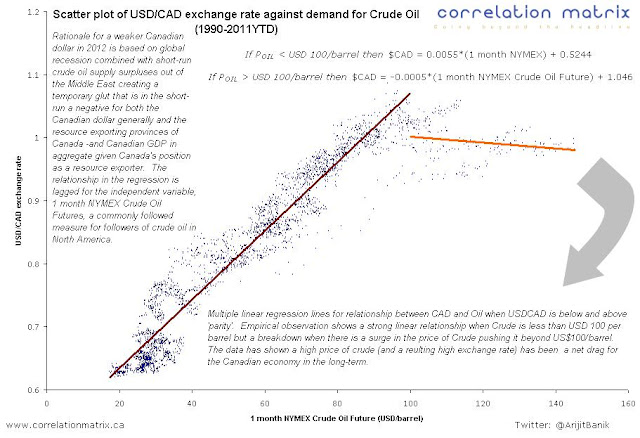

- The value of the Canadian dollar (from a flow of funds as opposed to pure speculation view) rests on the demand for energy based commodities and Canadian goods and services; a strong dollar remains a noose around the sustainable expansion of the Canadian economy as Canada continues to lag in terms of productivity versus the United States where capital uptake is substantially higher and firms can take advantage of economies of scale.

- Global demand and supply dynamics vis-à-vis international trade will be driven by the developing world rather than the developed but both face their unique set of challenges: the developed world with social unrest as the social contract of a safety net unravels under the scathing sword of austerity juxtaposed against the profligacy of failed leadership; the developing world with inflation as a burgeoning middle class and greater leveraging (through credit access) making the aspirational wants of tomorrow a reality today.

- Canada is not an island unto itself; it remains linked to and wholly dependent upon the United States where the challenges of societal inequity are only outstripped by the the self absorbed incompetence of the political class.

- A nation's balance sheet should be thought of in terms of the businesses, various levels of government, households and banks: these balance sheets influence the aggregated demand in the economy and (when over leveraged and indebted after many years) skew growth expectations to the downside.

A stylized view of the Canadian economy

Why will rates remain low over the long term?

Deleveraging

At current rate of US savings --and assuming that there is no further relapse in housing or appreciation in market values of residential properties in the United States-- it will take 12 years to deleverage (see Technical Box 1 of the October MPR).

Japan vs. US in perspective

But while US consumers are deleveraging, Canadian consumers and governments have been leveraging up and taking on more debt.

Debt

Canada's Deficits and Debts - historical overview of recent political economic history

The austerity path entails sitting out a growth cycle (at a minimum) and seeing no substantive improvement in the net worth of a nation's citizens. In Canada, this path was undertaken in the mid-1990s by Jean Chretien's Liberal government (with Paul Martin as Finance Minister) after painful cuts to programs and transfers to the provinces; are the developed economies in Europe and the United States going to go along a similar path? The UK appears to be doing that at this point.

Canada re-embarked on the path of deficit spending in the modern era under the Liberal governments of Pierre Trudeau in the 1970s (when Federal debt/GDP ratio was 22%); these deficits and the resulting debt ballooned under the Progressive Conservative governments of Brian Mulroney in the 1980s but for a small open economy (SOE) the bell tolls quickly; while Canada sleeps next to the elephant, it never will be the elephant as that beast is the global hegemon with the world's reserve currency. Growing deficits and spiralling debt were deemed unsustainable by the capital markets with Canada losing its AAA credit rating in April 1993.

The most influential policy advisers behind the scenes in Ottawa --David Dodge and Peter Nicholson-- convinced the Prime Minister and Finance Minister by 1995 that deteriorating external market opinion --WSJ characterized the Canadian dollar as the Canadian peso-- would entail one essential prescription: smaller government ("restructuring") leading to cuts on the expenditure side of the ledger than would in turn lead to a slaying of the deficit dragon (Federal debt/GDP ratio was 71% in 1995). If this route was not followed then a visit from the IMF would be forthcoming.

The political will today is for austerity and against stimulus --even if the binary nature of the decision is a false one-- and as such the risk to growth remains to the downside. Every nation intends to muddle through by following in Canada's footsteps even if they intend to do so at varying speeds.

The Chretien Liberals took a right of centre "Keynesian" (meaning counter cyclical) fiscal policy approach by enacting cuts to spending, paying down debt, increasing taxes and building up surpluses during the growth phase of the business cycle.

In retrospect, the austerity policy meant that Canada lagged in terms of: (i) growth --which deflated political allies at centre such as former TD economist Doug Peters who advocated growth before austerity; and (ii) social programs and combating inequity--which was criticized by opponents on the left yet, ironically, was praised by opponents on the right such as the Fraser Institute. The outcome of policy was evident as a noticeable brain drain of talent left Canada for the greener pastures of the United States and elsewhere, many never to return.

No two nations have an identical political economy; Canada's restructuring can be see as necessary medicine for a SOE that is a price taker in world markets but the future of the Canadian debt situation remains mired in the fog of policy uncertainty versus political will.

Will the lessons learnt from the 1990s be lost since the frugality of that period provided breathing room for supply and demand side stimulus which left Canada's balance sheet less worse off than its developed world peers after the Great Recession? The closing of that deficit remains on hold with an uncertain trajectory but if that closing is realized then it will be a drag on the economy; we cannot assume crowding out when a nation is not at full employment.

A reduction in the growth of government spending (G) in the 1990s coincided with reduced growth in consumption (C) and fixed capital formation (I)

Debt and asset markets: Canadian Housing

If you are of the view that lower house prices represent a wealth transfer from households that own more housing than they plan to consume to new home buyers then a housing correction isn't necessary a problem. However, the key is that consumption can be crippled after a real estate asset crash: the cases of the United States, Spain, Japan and Ireland illustrate that it can (and will) take years to make up for the bursting of an asset bubble.

In terms of financial obligations, it is understood that a mortgage is a long-term financial commitment that can takes years to work its way out of a system and off the liability side of a household's balance sheet. South of the 49th parallel, 25% of US mortgage holders have negative equity in their homes while another 45% have less than 20% equity which constricts the confidence channel meaning; the "poverty effect" at the micro level translates into a lack of confidence in the aggregate; the under water mortgages create a "ball and chain" tying an individual to a particular location and precluding the opportunity for job relocation.

But does the American experience hold true for Canada? Of course, the argument in defence of high and rising real estate costs in Canada is that housing is ultimately local and the dearth of quality housing stock supply in a large city like Toronto is small and of questionable quality when compared to the outsized demand of those who wish to settle there.

The concern is that Canada today is where the United States was circa 2005-6. At that time, Michael Hudson's highly readable and entertaining piece The new road to serfdom: an illustrated guide to the coming real estate collapse was published in Harper's magazine:

America holds record mortgage debt in a declining housing market. Even that at first might seem okay—we can just weather the storm in our nice new houses. And in fact things will be okay for homeowners who bought long ago and have seen the price of their homes double and then double again. But for more recent homebuyers, who bought at the top and who now face decades of payments on houses that soon will be worth less than they paid for them, serious trouble is brewing. And they are not an insignificant bunch

Can Canadians maintain their current debt trajectory?

Debt capacity = f {PAssets / PDebt, cost of funding, expected income growth}; if the majority of Canadians are not seeing rises in real income then it brings into question the sustainability of the increased indebtedness while the cost of funding has kept debt servicing manageable and the asset to debt multiple has made Canadian homeowners feel richer - especially those with plenty of equity in their properties.

Household debt to personal disposable income

Historical Canadian Prime Rate

Historical Canadian Unemployment Rate

As a counterpoint, National Bank economists, Stefan Marion and Paul-Andre Pinsonnault have argues that Canadian indebtedness is less than that of American when health care costs are take into account.

But this fails to consider the reality of the two markets; the spending power of the American remains greater than that of the Canadian as she is able to purchase cheaper goods with lower retail and income taxes. Going forward, this may not be the case as America has the ability to take care of its fiscal situation (on the income side) at the federal level through increased taxation on consumption, fewer loopholes in the tax code, and enforcement of a progressive tax regime that is currently beholden to the whims of K street lobbyist while Canada faces a silently significant challenge: demographics.

Demographics

Recommended reading:

Fiscal Sustainability Report (September 2011) from the Parliamentary Budget Officer (Kevin Page).

Canada's Looming Fiscal Squeeze (Chris Ragan, McGill University) (powerpoint presentation).

Canada's Looming Fiscal Squeeze (published by the Macdonald-Laurier Institute, November 2011).

The Age of Aging: how demographics are changing the global economy and our world (George Magnus, January 2008)

http://www.footwork.com/ (David Foot, University of Toronto demographer and author of Boom, Bust and Echo)

Declining population growth

Recommended reading:

Fiscal Sustainability Report (September 2011) from the Parliamentary Budget Officer (Kevin Page).

Canada's Looming Fiscal Squeeze (Chris Ragan, McGill University) (powerpoint presentation).

Canada's Looming Fiscal Squeeze (published by the Macdonald-Laurier Institute, November 2011).

The Age of Aging: how demographics are changing the global economy and our world (George Magnus, January 2008)

http://www.footwork.com/ (David Foot, University of Toronto demographer and author of Boom, Bust and Echo)

The case for low secular rates via the demographic effect is based on Statistics Canada findings where (i) there is now the dominant baby boom cohort just retiring; (ii) lower fertility rates over the past generation (baby bust and echo cohorts) are entering their working years; and (iii) longer life expectancies, the proportion of Canadians over 65 will dramatically increase over the next two decades (see Canadian population pyramid evolution).

In 1946, retirees (over 65) proportion was 7.2 %; in 2006, 13.2%; and by 2056, it will be ~25 %.

This retiree shift will reduce the proportion of the population who are productive, while increasing the proportion who are drawing upon government services and pensions (the dependency ratio). Older Canadians have a higher demand for healthcare but lower demand for other goods and services which translates to lower aggregate demand (via lower consumption). Most importantly, older Canadians hold the political power and as we all understand, fiscal policy is politically constrained, so the entitlements will flow unless the governing party in power wishes to be kicked out of power.

This retiree shift will reduce the proportion of the population who are productive, while increasing the proportion who are drawing upon government services and pensions (the dependency ratio). Older Canadians have a higher demand for healthcare but lower demand for other goods and services which translates to lower aggregate demand (via lower consumption). Most importantly, older Canadians hold the political power and as we all understand, fiscal policy is politically constrained, so the entitlements will flow unless the governing party in power wishes to be kicked out of power.

Declining population growth

Increasing entitlement burden and increasing health care costs

Dependency ratio will increase as working age population (and labour force participation rate) decreases

This will result in a drag in per capita GDP without a massive increase in productivity

Income support programs

Fiscal squeeze

Christopher Ragan, "Canada's Looming Fiscal Squeeze," November 2011

"The inconvenient truth that Canadians and their governments must immediately face is that the existing demographic forces and the fiscal implications that follow are so large that governments will need to respond by making fundamental adjustments to their fiscal frameworks. As is always the case, the simple arithmetic of government budgets implies that there are only two broad fiscal choices available to address the looming fiscal squeeze. Spending programs can be reduced or eliminated or taxes can be increased. There is nothing else."

Development

Wonkish sidebar

The degree of development has been left for last as it ties into how inflation will funnel through in developed and developing economies. On the one hand there is the conventional wisdom that "inflation is always and everywhere a monetary phenomenon." This meme is parroted by the intelligensia and and the respect of Milton Friedman's hucksterism within the fawning media means that it is not surprising to recognize why we are in an economic quagmire.

When Friedman coined the cliché he had referred to a one commodity economy with no technical change, eliminating the possibility of differential price movements, as well as excluding income distribution effects and quality change. While these unrealistic assumptions appear absurd, they formed the basis of Friedman's case for positive as opposed to normative economics. Given that we live in the real world as opposed to the fairy tale existence where we are rational economic actors with the foresight of prophecy, we will ignore the former positivist approach.

For a nuanced view, where we have the situation of the monetary base being increased greatly, Friedman's aphorism can be true but does not necessarily have to be true. The FED's actions, and those of the Swiss National Bank attest to that: ultimately the FED's action has led to the exporting of inflation to the developing economies (despite the analysis of the San Francisco FED economists who maintain that this has not the case). The combination of a liquidity trap and balance sheet repair domestically, and the search for growth internationally through portfolio capital flows has meant no inflation in the United States but serious asset inflation elsewhere.

But if Freidman's aphorism was meant to mean that "governments printing money create inflation" then the term is undeniably false: inflation --specifically hyperinflation-- is the result of three inter-related factors: (i) increase in money supply of fiat currency combined with (ii) social and political stress often associated with post-war political instability, civil war, or adjusting to defeat as a consequence of war and (iii) weak government.

In a developed economy such as the United States, which remains a global hegemon despite being a waning empire, the ballooning of the monetary base without a concomitant increase in the velocity equates to benign domestic inflation. The United States is not Weimar Germany and hopefully will never be.

Understanding development is important because inflation reflects increases in demand and the growth of the developing world entails greater demand for commodities. Commodity price increases, particularly food, funnel through to headline inflation that has a 15% weighting in the U.S.; a 30% weighting in China.

Canada is a net exporter of commodities related to energy and foodstuffs within the broad dynamic of the global market. The deleveraging and debt burdened developed economies on an austerity path entails slower commodity demand; the growing and leveraging developing economies on a growth path entails greater demand for commodities which in turn signals demand for the loonie. The Canadian currency, when rising, acts as a drag on the economy while improving the nation's terms of trade and lessens the requirement for hiking.

Canada is a net exporter of commodities related to energy and foodstuffs within the broad dynamic of the global market. The deleveraging and debt burdened developed economies on an austerity path entails slower commodity demand; the growing and leveraging developing economies on a growth path entails greater demand for commodities which in turn signals demand for the loonie. The Canadian currency, when rising, acts as a drag on the economy while improving the nation's terms of trade and lessens the requirement for hiking.

However, in either a developed or developing economy, the critical factor remains the pricing power of labour. The occurrence of real wage increases determines the persistency of inflation; diminished labour power (since the neoliberal revolution of the late 1970s) has meant that companies have not had to build in cost of living allowances and so the real spending power of workers can only increase through career progression (which is unrealistic for many) or an increase in the value of assets owned in relation the value of debt owed. Absent real wage increases, reliance on increasing prices of real assets and selling those at a capital gain connotes a ponzi economy: this was Spain, Ireland and the United States and is now Canada.

An economy in which income cash flows are dominant in meeting balance-sheet commitments is relatively immune to financial crises: it is financially robust. An economy in which portfolio transactions are widely used to obtain the means for making balance-sheet payments can be crisis-prone: it is at least potentially financially fragile.

Hyman P. Minsky, Stabilizing an Unstable Economy, p.227, McGraw-Hill 2008

If inflation becomes an issue in the developed world then it is a transient one. There is no need for it to persist in a developed capitalist state: the way to break the back of inflation is to break the back of "average" wage earner. This is what former FED Chairman Paul Volcker succeeded in doing in the 1980s and it is what former Bank of Canada Chairman John Crowe perfected in the early 1990s by manufacturing a harsh made in Canada recession that brought headline inflation to close to zero in 1994. (See the unemployment chart above that ensued as a result of the religious zeal for price stability).

A policy direction of that magnitude would be disastrous for Canada now and make the interest rate forecast appear bullish.

The argument here is that the Bank of Canada and Department of Finance would, through the levers of monetary tightening by subtlety and fiscal tightening by stealth, rather engineer a soft landing in residential housing sector and permit an orderly reset so that house price affordability ratios revert to a long term mean rather than deal with the ramifications of a property crash or severe correction. While asset prices are not an explicit part of the BOC mandate, they are clearly weighing heavily on decision making --residential investment was part of consumption in TOTEM while it is modeled separately in TOTEM2.

Wonkish sidebar: Renovation + new housing + transfer costs = Residential investments from National Accounts

Wonkish sidebar: Renovation + new housing + transfer costs = Residential investments from National Accounts

We have seen that monetary policy has been largely ineffective at the lower bound yet it remains incredibly potent in terms of choking off economic growth due to the sensitivity of Canadians to rate hikes.

Assuming that rates along the trajectory of a business cycle go from 1% to 2.5%, we can observe how debt servicing would increase on a mortgage of an "average" City of Toronto home owner (May 2011 data). The extra 150 bp in rate increases translates to a yearly debt servicing increase of $5,376 dollars on a variable rate mortgage whose principal amount was $535,807.

Wonkish sidebar: I am not subscribing to the New Classical notion of one representative agent as I prefer the analogy of a phase transition where a mass of people do a similar thing and pursue similar options at once due to social pressure. There must be a consequence to social structure that constrians some outcomes and encourages others.

Keep in mind that in the real world, an increase in debt servicing is not isolated; increased commodity prices funnel through to the monthly grocery and fuel bill also: in aggregate, absent a real wage increase and access to further credit to supplement income, this translates to lower consumption.

Where will domestic inflation come from?

The middle class in the developing world is seeing gains in real incomes; this drives headline inflation over there.

The middle class in the developed world is seeing stagnation in real incomes; as such. rising commodity prices have the pervasive effect of being contractionary in North America where, for example, an increase in gasoline costs must be absorbed (like a tax) by the consumer who will have to ration consumption elsewhere without resorting to the usury of credit card financing in order to make purchases of necessities possible.

The reality is that globalization and technological change (typically embraced by developed nations) has meant that many former middle class jobs will not be returning any time soon and this concern is exacerbated if the combination of globalization and technology moves up the income "food chain".

Ultimately, if the domestic middle income wage earner is gutted then the domestic middle income target market is diminished; producers will have to cater to a market for the plutocrats and a market for the rest.

The reality is that globalization and technological change (typically embraced by developed nations) has meant that many former middle class jobs will not be returning any time soon and this concern is exacerbated if the combination of globalization and technology moves up the income "food chain".

Ultimately, if the domestic middle income wage earner is gutted then the domestic middle income target market is diminished; producers will have to cater to a market for the plutocrats and a market for the rest.

Ultimately, this again entails less labour pricing power and less expectation of inflation growth.

Key takeaways

- This is not a doomsday scenario that predicts depression for Canada; it is a scenario that argues for low secular rates.

- It does predict slower growth based on an (external austerity + deleveraging) dynamic in developed nations and (long term private debt management + societal aging demographic) dynamic domestically.

- It assumes benign inflationary environment due to no rise in real wages.

- It implies a disconnet between the health of corporations versus consumers as a cap on real wages and access to developing markets plus healthy corporate balance sheets act as a float to corporate profitability.

- It takes into account the downside risk of a real asset correction as opposed to a crash.

- It also implies that the policy makers in Ottawa are actively attempting to maintain asset reflation policies without having the Canadian economy go down the well trodden disastrous path of real estate crashes seen in other developed nations.

- The upside risk to this long term forecast is that developing world restructures much more quickly than expected so that they become consumers and not beholden to an export driven model of economic growth.

- Moreover, the upside risk assumes that China does not suffer from capital flight and India and Russia have manageable geopolitical concerns while Brazil is able to keep the inflation genie in the bottle (all possible/probable downside risks).

- Bank balance sheets matter; private balance sheets (in particular) matter; government balance sheets matter -- but no one knows the demographic tipping point for softness in housing.

- When does the demographic wave trigger no price appreciation and possible price depreciation in residential real estate?

- The rate of credit growth and the credit impulse/accelerator drives investment in a capitalist economy but if that investment is not in productive entrepreneurial activity but disproportionately funneled towards real and paper assets then there is the ponzi economy phenomenon.

The opinions reflected in this post 'No "rate normalization": a case for a secular trend of low rates in Canada' are those of the author and do not necessarily reflect those of the author's employer.