|

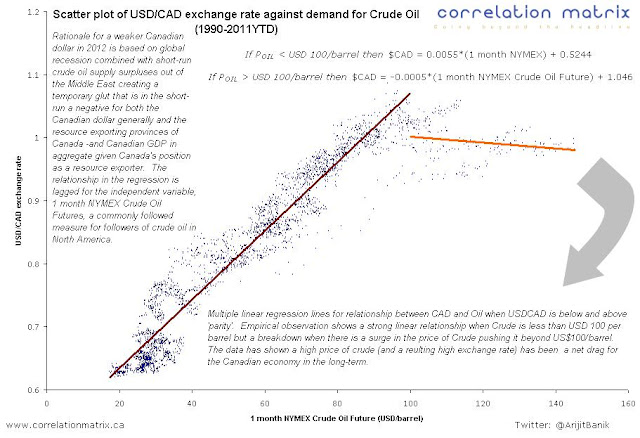

The Canadian dollar is viewed by captial markets as a petrocurrency but it that relationship does not always hold up. This is an update of a time series posted earlier that you may find useful in having a view on where the $CAD exchange rate is headed in 2012. Arguably, the demand for commodities generally and oil in particular may have weighed somewhat on BMO making a call for the loonie to trade at US 93 cents by year end.

|

Friday, September 30, 2011

Need a view on $CAD in 2012?

Monday, September 26, 2011

Advances in economic thinking: It is about the money

Steve Keen explains his dynamic model of the economy in this video from the Sydney Morning Herald.

Keen, an Australian economics professor at the University of Western Sydney, has received funding from George Soros's INET.

His economic model mathematically incorporates the ideas of Hyman Minsky, the circuit theory of endogenous money and systems modeling. Keen contends that

I will defer to another INET recipient, Leanne Ussher, on the need for new thinking in economics:

While stylized rather than mathematically rigorous, I argued in April that with the western economic system relying heavily on consumption to maintain growth and no real growth in wages for those outside of the top quartile of wage earners (citing the United States as a proxy for the advanced economies) it was actually the access to credit that was critical for the middle class to sustain consumption.

We are now firmly in the midst of paying down balance sheets and governments are under political pressure to move toward austerity. Businesses are not filling the void and the global dynamics of high savings in emerging economies due to consumers having no safety net entails that these potential markets are not the immediate solution to the West out of its malaise. All of this portends long term slow growth. The United States will not have the catalyst of another World War --at least, let us hope not for that would be the war to end all wars-- to bring it out of depression. The military industrial complex that has comprised the cylinders of its economic engine (below) since World War 2

Keen, an Australian economics professor at the University of Western Sydney, has received funding from George Soros's INET.

His economic model mathematically incorporates the ideas of Hyman Minsky, the circuit theory of endogenous money and systems modeling. Keen contends that

“You must have the monetary dynamics of capitalism properly incorporated to understand capitalism properly, so my model starts with banks’ loans and goes from there.”I agree wholeheartedly; we can learn significantly more from this form of thinking --incorporating Minsky-- than from the high priests of the mainstream guild.

I will defer to another INET recipient, Leanne Ussher, on the need for new thinking in economics:

The problem with economics as a science has been the dominance of some very narrow and specific types of tools that come under the heading of classical mechanics (see Mirowski’s (1989) More Heat than Light). This equilibrium approach, coped from Newtonian physicists and in particular their Hamiltonian equations, have come to dominate economics in describing ‘dynamics.’ Such tools underpin the DSGE macro models, which also have some random shocks based on historical data thrown in for good measure. Such ‘dynamic stochastic processes’ that DSGE models used for prediction, can be described as arbitrary at best, and represent the desire of scientists to find solutions that fit their specific type of economic thinking – one of preconceived notions of equilibria and steady states.

However, these methods are just mathematical and statistical tools, they cannot be blamed in of themselves. It is the application of these very specific tools, to the exclusion of all other methods, and the restriction of a pluralistic approach, that has made economics such a narrow and doctrinaire science – dominated by equilibria and representative agents.

In economics, using methods from other sciences, be that biology, physics, mathematics, statistics, engineering, psychology, anthropology, history or what have you, is ultimately an art, though combined with validation methods through experiments and statistics can help to make it a science. Using methods from physics can be used to offer a NEW way of thinking about economics, which opposes the current neoclassical or rational expectations regime.

As long as a pluralistic approach within the economic field is embraced, then we have a science that will benefit from the competition of ideas. It is when pluralism is banned, when specific methods and tools are excluded, or when outcomes are forced to satisfy certain conditions, that science becomes a backward art dominated by fad and fashion rather than progress.

Our approach is along the lines of complexity in economics and it is definitely NEW within the schools of economics, though it has parallels with Economic Institutionalism and Evolutionary Economics which emphasize institutional structure, interaction and demographics rather than with DSGE equilibrium macro models which are based on the psychology of a representative agent. A description of the complexity or emergent order approach within the field of economics can be garnered from an INET conference session earlier this year:

http://ineteconomics.org/net/video/playlist/conference/bretton-woods/K

Skidelsky and most economists are not opposed to the use of mathematics or physics in economics. It is rather the manner in which it is used to pursue a narrow line of thought and its dominance in the field that has led to the exclusion of a pluralistic approach.

While stylized rather than mathematically rigorous, I argued in April that with the western economic system relying heavily on consumption to maintain growth and no real growth in wages for those outside of the top quartile of wage earners (citing the United States as a proxy for the advanced economies) it was actually the access to credit that was critical for the middle class to sustain consumption.

We are now firmly in the midst of paying down balance sheets and governments are under political pressure to move toward austerity. Businesses are not filling the void and the global dynamics of high savings in emerging economies due to consumers having no safety net entails that these potential markets are not the immediate solution to the West out of its malaise. All of this portends long term slow growth. The United States will not have the catalyst of another World War --at least, let us hope not for that would be the war to end all wars-- to bring it out of depression. The military industrial complex that has comprised the cylinders of its economic engine (below) since World War 2

should give way to a different paradigm but such structural adjustments take years.

Labels:

economy,

INET,

Leanne Ussher,

military industrial complex,

Minsky,

money,

Steve Keen

Friday, September 23, 2011

Rajan on income inequality caused by technology and globalization

I mentioned in a previous blog post Raghuram Rajan's analysis on income inequality that has been articulated in his book and blog Fault Lines. Here is the chart as a reminder:

And here is the takeaway (for me) in the form of a 2 x 2 matrix (beloved by those in the consulting field) from a speech he made in Toronto on Tuesday, September 20:

The case for higher structural unemployment --think of the widening gap between official and U6 unemployment-- is in the left column of the matrix.

The "routine" skilled work has been displaced by technology and the "routine" unskilled work has been shipped off shore thanks to the corporate globalization model.

Those of us in the west are in an ever losing battle to stay ahead of the technology cycle so that our jobs remain "non-routine" and preferably "skilled".

And here is the takeaway (for me) in the form of a 2 x 2 matrix (beloved by those in the consulting field) from a speech he made in Toronto on Tuesday, September 20:

The case for higher structural unemployment --think of the widening gap between official and U6 unemployment-- is in the left column of the matrix.

The "routine" skilled work has been displaced by technology and the "routine" unskilled work has been shipped off shore thanks to the corporate globalization model.

Those of us in the west are in an ever losing battle to stay ahead of the technology cycle so that our jobs remain "non-routine" and preferably "skilled".

Labels:

globalization,

inequality,

Raghuram Rajan,

technology

Thursday, September 22, 2011

US Non farm payrolls foreshadows depression

It is only of academic interest to those at the NBER as to whether the U.S. will officially have a recession in the coming quarters. A rule of thumb for job growth coming out of a deep recession --as that experienced after 2008-- is that in aggregate an economy the size of the United states should be 'creating' approximately 250-350 thousand jobs a month (my assertion is based on BLS not ADP figures). That range is represented by the grey band in the bottom right chart. The fact that has not been happening explains the unemployment rate on the left and the widening gap between U6 (reflecting real unemployment) and the official unemployment rate. Notwithstanding Paul Krugman's protestations, there is a structural problem at work here. Routine work that is low skill and routine work that is high skilled has been displaced by a combination of technology and corporate globalization. Those jobs will not come back. Absent a credit induced increase in consumption --very unlikely as households pay down debt-- and businesses hiring --also unlikely given the dearth in demand as Say's Law is not at play here after a real estate crash-- and visionary government works --again unlikely as the United States begins on the long road towards austerity-- and banks lending --unlikely given their poor capitalization, over leverage and future Basel III regulations-- we are on the cusp of low sub-trend growth (not because of what the New Classical economists stated but) because of the real role of credit in our economy and what the lens of history will call the Great Depression of the Second Millennium.

Wednesday, September 21, 2011

Opinion: Stumbling towards austerity; readying for crisis

Three Years On

I do not want to be perceived as raining on the policymakers' parade --theirs is not an easy job-- but three years after Lehman Brothers went bankrupt observers saw an adrenaline induced pop in global markets as a result of the co-ordination between the European Central Bank and others to lend dollars to banks to tame the euro sovereign debt crisis.

This was nothing more than a palliative.

The ECB side of the story is that it "is ensuring that financially sound European banks will not face short-term funding problems even under stressed market conditions." (Joachim Nagel, member of the governing board of the Bundesbank)

I do not want to be perceived as raining on the policymakers' parade --theirs is not an easy job-- but three years after Lehman Brothers went bankrupt observers saw an adrenaline induced pop in global markets as a result of the co-ordination between the European Central Bank and others to lend dollars to banks to tame the euro sovereign debt crisis.

This was nothing more than a palliative.

The ECB side of the story is that it "is ensuring that financially sound European banks will not face short-term funding problems even under stressed market conditions." (Joachim Nagel, member of the governing board of the Bundesbank)

It will not work: liquidity solutions (suitable to Italy only) do not solve the solvency problems relevant to the rest).

Here are the harsh realities: the inevitability of Greece's default is nigh; Italy's sovereign credit rating downgrade heightens the risk of contagion as Eurozone based corporations increasingly look to places (other than European banks) to park their funds.

Why would this happen? As Bloomberg economist Joseph Brusuelas has shown in the chart below, bank debt --in light of the sovereign holding in Europe-- poses a greater systemic risk to Europe's largest economies and Germany's "bad banks" in particular will be hit hard when Greece defaults and German taxpayers will foot the bill.

Here are the harsh realities: the inevitability of Greece's default is nigh; Italy's sovereign credit rating downgrade heightens the risk of contagion as Eurozone based corporations increasingly look to places (other than European banks) to park their funds.

Why would this happen? As Bloomberg economist Joseph Brusuelas has shown in the chart below, bank debt --in light of the sovereign holding in Europe-- poses a greater systemic risk to Europe's largest economies and Germany's "bad banks" in particular will be hit hard when Greece defaults and German taxpayers will foot the bill.

In the arcane world of bank capital management, sovereign credit downgrades at the macro level create a downward spiral that can lead to bank downgrade at the micro level when the banks are over leveraged and insufficiently capitalized:

Bring back Political Economy

Have policy makers thought out of the box in response? Arguably not much because in terms of implementation --think of quantitative easing, EFSF-- we have seen stop gap measures reliant on the notion that equilibrium will be restored in time.

Have policy makers thought out of the box in response? Arguably not much because in terms of implementation --think of quantitative easing, EFSF-- we have seen stop gap measures reliant on the notion that equilibrium will be restored in time.

Amid the cacophony of noise that is the vacuous circus of business journalism, and as the summer of 2011 wound down, there have been some voices of reason espousing heterodox thought while conventional thinking has been an abject failure.

It is time to time to dust off a classic of political economy; consider the following seemingly heretical anti-establishment opinions:

- Nouriel Roubini lamented that Karl Marx was right. (WSJ video interview)

- George Magnus, much to the horror of disbelievers (who have never read works of political economy) and the chagrin of true believers who await for egalitarian utopia, urged policymakers to "Give Karl Marx a Chance to Save the World Economy" (Bloomberg article)

- Umair Haque, Director of the Havas Media Lab and author of The New Capitalist Manifesto: Building a Disruptively Better Business weighed in on the topic with a recent blog entry with the provocation: Was Marx Right? (Harvard Business Review blog)

What can the dead drunken german intellectual with carbuncles teach me?

Yes, the ideal of communism led to political disasters --this post does not advocate a renunciation of a market economy for a top down centrally planned utopia-- but as Mark Blaug noted that Marx wrote “no more than a dozen pages on the concept of social class, the theory of the state, and the materialist conception of history” while he wrote “literally 10,000 pages on economics pure and simple.” (Mark Blaug, Great Economists before Keynes (Highlander, N.J.: Humanities Press International, 1986), p. 156.)For the uninitiated who require a 101 recap, take a look at the video of Cranfieldrapid distillation of Marx's theory of Crisis as it provides an accessible framework with which to analyze the seeds of the greatest challenge the developed economies have faced since the The Great Depression.

We can all learn something about the past and prescriptions for the future.

Yes, the ideal of communism led to political disasters --this post does not advocate a renunciation of a market economy for a top down centrally planned utopia-- but as Mark Blaug noted that Marx wrote “no more than a dozen pages on the concept of social class, the theory of the state, and the materialist conception of history” while he wrote “literally 10,000 pages on economics pure and simple.” (Mark Blaug, Great Economists before Keynes (Highlander, N.J.: Humanities Press International, 1986), p. 156.)For the uninitiated who require a 101 recap, take a look at the video of Cranfieldrapid distillation of Marx's theory of Crisis as it provides an accessible framework with which to analyze the seeds of the greatest challenge the developed economies have faced since the The Great Depression.

We can all learn something about the past and prescriptions for the future.

Of course, such a distillation of Capital: A Critique of Political Economy without a nuanced view of properly understanding one of the most controversial and influential figures in history irritates the true believers. As York University's Leo Panitch frames it, beyond past crisis, the uninitiated should recongize how it is that capitalism's fundamental characteristics of exploitation and alienation, class inequality and social isolation are reproduced in commodity production and market competition even in periods of capitalist dynamism, and how this too plays a role in generating both financial speculation and future crises.

Creative destruction

The takeawy here is that a capitalist system is inherently unstable over time but --for its believers-- the dynamism of the system rests on the Schumpeterian notion where there is a renewing process of transformation that accompanies radical innovation as opposed to --the perspective of capitalism's detractors-- for example the David Harvey position: "Both Karl Marx and Joseph Schumpeter wrote at length on the 'creative-destructive' tendencies inherent in capitalism. While Marx clearly admired capitalism's creativity he [...] strongly emphasised its self-destructiveness. The Schumpeterians have all along gloried in capitalism's endless creativity while treating the destructiveness as mostly a matter of the normal costs of doing business".

Jobs, jobs, jobs

The political economy of the current situation provides clarity in the fog of crisis: in hindsight, US President Barrack Obama should have concentrated on employment --as opposed to a watered down health care bill (known perjoratively as "Obamacare") that placated the rent seeking yet powerful insurance lobby and made no one (either on the right or left of the political spectrum) happy-- when the goodwill following eight disastrous years of George W. Bush's Presidency was palpable and --most importantly-- translatable into actionable policy when his term began in 2009.

America's unemployment situation remains a disaster --best represented by the U6 rate shown above-- and will not be corrected with unimaginative supply side tinkering of payroll taxes that encourage (at the margin) corporations to hire more workers. Supply side policies work during times of stability not depressions. The many Americans that have worked in unskilled sectors will not see those jobs come back thanks to technology and corporate globalization; it is something that an increase in education and job re-training cannot remedy.

The complexity of reality that requires daring thought has given way to the dogma of partisanship. The seemingly religious zeal advocating a fastrack to austerity in order to rekindle market confidence is based on the fallacy of composition equating federal government balance sheets being akin to those of households.

The complexity of reality that requires daring thought has given way to the dogma of partisanship. The seemingly religious zeal advocating a fastrack to austerity in order to rekindle market confidence is based on the fallacy of composition equating federal government balance sheets being akin to those of households.

Establishment thinking is not the prescription

The establishment doctrine that has dominated academic thought over the last generation promotes the primacy of monetary measures over the blunt instrutment of fiscal intervention and an adherence to free market fundamentalism. It is disappointing to see the take from the doyen of the New Classical School in a recent presentation where he implied that the government was doing too much and that "by imitating Eurpean policies on labor markets, welfare, and taxes U.S. has chosen a new, lower GDP trend."

The realities of day to day life illustrate that rational expectations and Ricardian equivalence have no merit for the ordinary person yet are part and parcel of what passes as wisdom within the halls of orthodox academic economics. As metioned, don't buy the false analogy of governments balancing budgets like households:

- Governments have the ability to tax; households do not.

- Housholds do not maximize the utilities of their decisions subject to budget constraints; in a capitalist society where materialism reigns and aspirations drive purchases people think emotionally and instinctively often and rationally seldom.

- Governments should run surpluses during good times --i.e. not cut taxes because they are politically expedient-- when households and business sectors may over extend themselves.

- suffering the aftermath of credit induced asset bubbles;

- weighed down by zombie banking sectors that are not serving their fundamental purpose of providing credit to spur entrepreneurial activity;

- burdened by visionless political leadership;

- falling into a low growth trajectory due to highly indebted consumers and over leveraged under capitalized banks.

Alternatives to the status quo

- Rekindling activist Industrial Policy is a start (though not a panacea) argue Michael Spence and Sandile Hlatshwayo in an important paper on The Evolving Structure of the American Economy and the Employment Challenge.

- For the hubris that remains the grand political experiment that is the Eurozone, I argued in January about the inevitability of Greek deafult and the need for formalized fiscal transfers.

- Greece will default, Ireland will adjust, Portugal will suffer as Spain now suffers but if Italy goes down, the eurozone will go down.

- Germany is right to complain after having suffered unification and no rise in real wages for 15 years via self-imposed Teutonic austerity but this is the time for german profundity to come to the fore if it believes the eurozone is worth saving for it will either pay now or pay later through an even greater crisis.

- As households repair balance sheets in America and business hoard cash given the dearth of domestic demand, government must decide what its role is in the economy; it is no longer enough to cling to the Ronald Reagan's aphorism from his first inaugural address that "government is not the solution to our problem; government is the problem"; it isn't

- On the expenditure side, supporting the productive capacity of the nation with long term public works programs and aiding the transition to a greener less fuel intensive economy is a better option than funding imperial adventures tahnks to bloated military Keynesian via the MIC

- On the income side, Obama's Buffet Tax is a populist small step yet the distortions in a convulted system that encourages a trickle down economics remain; this system --along with technological changes and corporate globalization-- has effectively hollowed out the middle class.

- It is time to throw the idea of The Great Moderation into the dustbin of economic thought and seriously revisit the orthodox notion that monetary policy trumps fiscal policy (based on reams of "intertemporal" analyses) when the Federal Reserve's own policies have done nothing to spur demand in a monetary transmission mechanism that is as faulty as that of the Chevrolet Corvair.

- Stop quantitative easing; it doesn't work and spurs commodity bubbles elsewhere thanks to free flowing financial capital (despite the Federal Reserve Board of San Francsico researchers arguing to the contrary here)

- A good analysis of the FRBSF's research here: "the article is reporting on using a one day window for looking at the effects of LSAPs on commodity and other asset prices. This is what is done in event study methodology. The results are interesting but we do not have any idea what the longer term effects are. The LSAP announcement itself could be seen as a sign of a weak economy and as a result, commodities and other assets fall in value. Over a longer time frame, the money from LSAPs could find its way into the financial markets (which, to some degree, is what I think happened)." Perry Sadorsky

- Rethink central banking; neither the FED's dual mandate nor the ECB's inflation targeting for a non-optimal currency area are the answer.

- More on that in the future

The opinions expressed are solely those of the author and not of his employer.

Labels:

capitalism,

crisis,

David Harvey,

employment,

eurozone,

George Magnus,

Hlatshwayo,

industrial policy,

Leo Panitch,

Mark Blaug,

Marx,

Nouriel Roubini,

PIIGS,

Sadorsky,

Schumpeter,

Spence,

Umair Haque

Subscribe to:

Posts (Atom)