Neither a borrower nor a lender be;For loan oft loses both itself and friend,And borrowing dulls the edge of husbandry.~Lord Polonius from William Shakespeare's The Tragedy of Hamlet, Prince of Denmark (Act 1, Scene 3)But apart from this contemporary mood, the ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist. (Keynes 1936) [ emphasis added]

Whether one admires, abhors or is agnostic towards Keynes' ideas, and regardless of one's political and philosophical leanings, there remains an enduring truth to the quotation above, gleaned from the concluding remarks of the General Theory. The Bard of Avon, in contrast, remains as timely and timeless as ever; the truism of being neither a borrower nor lender holds true for all that have suffered from the exuberance of asset bubbles: think of the the desolation of popped assets that are buried among the rubble of balance sheets that need to be repaired and reconstructed around the world.

Four years on from the Great Recession, the lay person is perplexed in coming to terms with understanding the seemingly inexorable forces of globalization: concentrated corporate power, a bottomless global reserve pool of labor and technology enabling job redundancy and off shoring -- all ingredients behind the constant change, instability and fragility that is manifested in the increasingly precarious nature of work and living. Exacerbating the discomfort is waning faith in the political class --something that admittedly ebbs and flows even during the so-called "good times" -- that is arguably at a post World War II low in much of the developed as well as in pockets of the developing world.

Turning to traditional media and, by and large, witnessing the debates within the narrow bounded confines of possible prescriptions sold as solutions is nothing but Conventional Wisdom (in John Kenneth Galbraith's pejorative sense of the phrase).

Otto von Bismarck said that "Politics is the art of the possible" (Die Politik ist die Lehre vom Möglichen) but the misbehavior of Congress over the so-called "fiscal cliff" proves that the love of farce is not isolated to Old Europe and Classical Antiquity but has a captive audience in Washington D.C., home of the imperium. As Kevin Kallaugher's (better know as Kal in The Economist newspaper) energetic cartoons illustrate, U.S. President elect Obama's coming term is likely to be as bumpy as his previous one, particularly given his penchant for negotiating from a position of weakness and love of appeasement (via dismantling of the social contract) in order to deliver a `grand bargain`.

Meet The New Boss

...Same as The Old Boss

The United States is not peripheral Europe: it is the hegemonic power; it remains unrivaled militarily; it is issuer of the world's reserve currency in a fiat based currency world; it has far greater flexibility to enact a forward looking vision and craft policy for a new international financial architecture.

But will it do so? Not bloody likely.

This blog believes that Obama will wilt under the light of convention that has taken us from the farce of the "fiscal cliff" to the melodrama of another "debt ceiling"? Can he untangle himself from an already muscular foreign policy stance that, as an old post argued would put the country in a fiscal straitjacket. In divining the art of the possible, it is necessary to discern the wasteful from the productive. Endless foreign incursions and skirmishes are wasteful --but America is addicted to war-- while public investment by way of government spending need not be. The traditional narrative around the American debt situation revolves around the sustainability (or lack thereof) of the American fiscal picture. This has been further muddied by oft repeated (Reinhart and Rogoff 2011) citation:

In our study “Growth in a Time of Debt,” we found relatively little association between public liabilities and growth for debt levels of less than 90 percent of GDP. But burdens above 90 percent are associated with 1 percent lower median growth.Yet there is an untold truth that no talking head is willing to acknowledge: no one knows how much debt is too much.

The story so far, that is familiar to all: the American economy is meandering along at a rate that is far below 'potential.' The obvious counter-factual here is what happens to the purported trend rate of growth if the easy liquidity and household debt expansion from 1990 - 2007 is decreased during said period below?

Despite the pedal of monetary policy being pressed to the metal of central bank intervention during and after the Great Recession there remains a large amount of 'slack' in the economy. Forays into 'fiscal stimulus' have spooked the markets and set forth the narrative in the United States that even after conquering the 'fiscal cliff' and navigating the up coming 'debt ceiling' the US government will (surely?) hit a 'debt wall' and, as a result, businesses are unwilling to invest because the ghost of uncertainty keeps visiting from the past, present and future. The supply side story makes sense if one believes in fairy tales as the gospel truth rather than as metaphor. Just as there are two sides to a trillion dollar coin, there are two sides to the economic story. The importance of the supply side is given space in the corporate media as it holds muster through the filters of ownership and advertising and is consonant with the news shapers and news makers but the demand side story must not be neglected even if it given short shrift.

Debt: How Much Is Too Much?: The curious case of Japan

In light of Japanese Prime Minister Shinzo Abe`s recent declaration of a 10.3 trillion yen (USD 117 billion) stimulus package, ostensibly to kick start the moribund economy, Peterson Institute President Adam Posen observed:

Japan demonstrates a different reality about the problems of excessive debt – one that Shinzo Abe, its new prime minister, should keep in mind as he launches a fiscal stimulus package. Japanese public debt has ballooned for 20 years, rising from 60 per cent to 220 per cent of gross domestic product (though the true figure net of government holdings may be 130 per cent). During that time Japan has been in recession, recovery and back in recession, but interest rates on Japanese government bonds have remained below 2 per cent for the past 13 years. While the debt accumulated, the yen appreciated from Y130 to Y78 to the dollar, before reversing to Y89 over the past few months.

Japan was able to get away with such unremittingly high deficits without an overt crisis for four reasons. First, Japan’s banks were induced to buy huge amounts of government bonds on a recurrent basis. Second, Japan’s households accepted the persistently low returns on their savings caused by such bank purchases. Third, market pressures were limited by the combination of few foreign holders of JGBs (less than 8 per cent of the total) and the threat that the Bank of Japan could purchase unwanted bonds. Fourth, the share of taxation and government spending in total Japanese income was low. (Posen 2013) [ emphasis added]

FT columnist Gillian Tett, whose analyses uses an anthropological framework, stated

One striking feature of the Japanese government bond markets in recent years is that domestic investors (who own 95 per cent of outstanding JGB stock) have continued to buy bonds, even amid ratings downgrades in the JGB market, with an extraordinary sense of quasi-patriotism. That is bad in some respects, since it removes pressure for change; but it may also make it less likely that Japan will rip itself apart. (Tett 2010) [ emphasis added]Moreover, in a recent IMF working, the composition of Japan`s sovereign debt portfolio shows that the country has an advantage as a currency issuer in a fiat money world, and this advantage is shared by a number of countries in the same situation but is contrasted by those countries that are not.

(Arslanalp

and Tsuda 2012, p. 12)

According to the authors` methodology, Japanese sovereign debt had a lower investor base risk than that of Canada (which no doubt would be met with howls of protest along Bay St. and in the corridors of Ottawa).

(Arslanalp and Tsuda 2012, p. 42)

(Arslanalp and Tsuda 2012, p. 43)

...and as such Japan is neighbors with the United States, United Kingdom, and the Teutonic powerhouse, Germany, rather then the peripheral eurozone.

(Arslanalp and Tsuda 2012, p. 44)

The level of sovereign debt in a nation in a global economy where the value money is by fiat is constrained not by how much debt is owed but by how much control the sovereign has over its affairs: (i) is it a currency issuer; (ii) how much of the debt is in the hands of foreign entities; (iii) how important is social cohesion in the country; (iv) what role does government play in the role of keeping the glue of a social contract: will it play the role of Hobbes` Leviathan or will it sell off public goods in favor of privatizing and feeding the great vampire squid wrapped around the face of humanity or will it be something in between?

Capitalism is necessarily messy and subject to fluctuations but the notion of government always and everywhere crowding private investment is a necessary fiction upholding the myth that free enterprise simply happens in a vacuum. Investments today in a productive capacity can lead to something that we cannot foresee tomorrow. The role of financial capital should be to aid and abet entrepreneurial activity rather than exist for itself as a rent seeking activity. We will get through the current crisis --just like those in the past (below)-- but to do so without a serious consideration of government's role would be naïve.

The key takeaway here is that government debt must be taken on a case by case basis; equating it to a household is often fallacious but it is the debt of households proper that should be of greatest concern.

Readers here are familiar with Keen`s hypothesis that the housing bubbles have been generated by the willingness of the financial sector to extend credit. In aggregate, one person`s debt may be another person`s asset logically...

but practically, debts and assets do not simply even out: there is a heterogeneity in debt levels among different classes of households --those who need the most financing are hurt the most-- and where they live becomes a factor as the amount banks are willing to lend is based on comparables.

Your Personal Debt Matters More - but your deleveraging was triggered by the boom in housing.

Mian and Sufi estimate that homeowners borrowed more than a trillion dollars from 2002 to 2006 through home equity loans, and that homeowners did not use the extracted funds to pay down other debts or purchase financial assets. This suggests that loans were used primarily for spending, which is supported by other studies indicating that households use home equity loans mainly for home improvements and other consumer items.

As the housing market started to unravel in 2006 to 2008, homeowners who had piled on debt began defaulting on their loans. In particular, the study finds that the default rate for low credit-quality borrowers in cities where house prices increased the most jumped by 12 percentage points, compared with only a 4 percentage point increase in areas that experienced little price appreciation. (Sufi 2011)

Homeowners in cities where house prices rose quickly borrowed more, but the response varied depending on the type of consumer. (Sufi 2011)

Central Banking Has Limitations

Japan has shown us the way... (but the map may be pointing us in the wrong direction).Where are we today? In the dismal world of central banking where monetary policy is supposedly the only game in town, and static partial equilibrium diagram do more to obfuscate than to explain, we are in a `Liquidity Trap`where monetary policy remains largely ineffective at the zero lower bound (ZLB in the diagram below).

It is really about the creation in the banking system (Yamaguchi 2012):

Ben Bernanke and his beard are doing what they believe to be Right

However, for monetary policy to be effective it has to be about more than just the stock of base money.

Because at the ZLB success has been very limited to none.

More to Hyperinflation Than "Printing Money"

(Weeks 2012)

Excess Reserves Are Potentially Dangerous in terms of inflation risks during normal times

...central banks’ quantitative easing policies have brought excess reserves in the developed economies to extremely high levels. Excess reserves now amount to 13.3x the statutory reserves required to maintain the money supply in the US, with corresponding figures of 4.9x for Japan and 5.0x for the eurozone (Koo 2012, p. 2)

That such inflation has not been observed in Japan, the US, or Europe is attributable to the fact that, in spite of zero interest rates, businesses and households are not only not borrowing money but are actually paying down debt. Reserves supplied by the central bank cannot leave the banks in the form of loans and therefore remain trapped in the banking system.Businesses and households are not borrowing even though interest rates are at zero because their balance sheets were severely damaged when the asset price bubbles burst. Put differently, quantitative easing policies have had no impact on prices or economic activity thus far because there is no private-sector demand for funds.There is no reason why unconventional monetary accommodation should work during a balance sheet recession. But nor will it do any harm because funds supplied by the central bank simply accumulate within the banking system. (Koo 2012, p. 3)

From your scribe`s point of view, the main reason that hyperinflation will not result from excess reserves is because those reserves are not spent into the economy – some argue that the American money center banks (for one) have been rehypothecating via the repo market – but if there is excess lending – more money lent than industrial production and household consumption warrants -- then, yes there will indeed be inflation.

Bottom Line: Household debt burdens in many parts of America are still very high and employment in the economy as a whole is affected by subdued consumption; there is an asymmetry here as the small class of the population that is relatively un-levered will drive the spending but whether it can continue to do so while the shenanigans domestically (debt ceiling) and internationally (Eurozone) continue is anyone`s guess. In the meantime, households --the sector that counts-- must continue to delever.

And in the aftermath of crashes, financial repression lasts a long time (Hoisington and Hunt 2012)

Deleveraging: No Easy Way Out (Minack 2012)

In the long run, we have Financial Repression (Montier 2012)

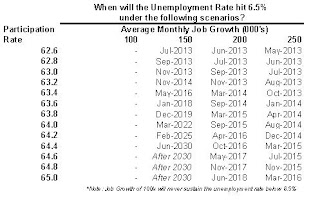

Even with the "Evans Rule" - Be Prepared To WaitPeople are right to think that interest rates must go up in the future but by how much and when is the question. In 2011, this blog made the case for a long term secular trend of low rates without rate normalization given the facts surrounding the global economy and impending demographic changes; the facts must change in order for the position to change.

The opinions reflected in this post 'Debt: How Much Is Too Much"bare those of the author and do not reflect those of the author's employer.

References:

John Maynard Keynes, The General Theory of Employment, Interest and Money, (Palgrave Macmillan, 1936) http://www.marxists.org/reference/subject/economics/keynes/general-theory/ch24.htm (accessed December 20, 2012), chap. 24.

Reinhart, Carmen M., and Kenneth S. Rogoff. "Too Much Debt Means the Economy Can’t Grow: Reinhart and Rogoff." Bloomberg View, July 14, 2011. http://www.bloomberg.com/news/2011-07-14/too-much-debt-means-economy-can-t-grow-commentary-by-reinhart-and-rogoff.html (accessed January 16, 2013).

Tett, Gillian. "Funding and the patriotism

test." Financial Times, FT.com edition,

sec. Columnists, January 7, 2010. http://www.ft.com/intl/cms/s/0/0306069c-fbb4-11de-9c29-00144feab49a.html

Arslanalp,

Serkan, and Tsuda, Takahiro. “Tracking Global Demand for Advanced Economy

Sovereign Debt.” IMF Working Paper 12/284, December 2012. http://www.imf.org/external/pubs/ft/wp/2012/wp12284.pdf

Steve Keen, “The fiscal cliff – lessons from the 1930s: Report to US Congress, 6 December 2012”, real-world economics review, issue no. 62, 15 December 2012, pp. 98 http://www.paecon.net/PAEReview/issue62/Keen62.pdf

Sufi, Amir. University of Chicago - Booth School of Business, "Capital Ideas: Painful Debt." Last modified 2011. Accessed January 17, 2013. http://www.chicagobooth.edu/capideas/dec-2011/painful-debt.aspx.

Koo, Richard. Nomura Equity Research, "Japan’s election and the dangers of unconventional monetary accommodation." Last modified December 11, 2012. Accessed January 16, 2013.

Kaoru Yamaguchi, Macroeconomic Dynamics - Accounting System Dynamics Approach. Draft Version 4 (2012). Accessed january 17, 2013. http://gmba.doshisha.ac.jp/about-us/people/kaoru-yamaguchi

Gerard Minack, "De Minimis Deleveraging", Morgan Stanley - Downunder Daily, November 27, 2012

Gerard Minack, "Can't Save Your Way Out", Morgan Stanley - Downunder Daily, November 29, 2012

James Montier, "The 13th Labour of Hercules: Capital Preservation in the Age of Financial Repression", GMP White Paper, November 2012.

Hoisington, Van R., and Lacy Hunt. Hoisington Investment Management Company, "Quarterly Review and Outlook Second Quarter 2012." Last modified 2012. Accessed January 17, 2013. http://www.hoisingtonmgt.com/pdf/HIM2012Q2NP.pdf

With the European central bank willing to do "whatever it takes" and the Americans content to admire their "Fiscal Cliff" there is no easy way out of the debt burden. Ten years ago it was common to single out Japan as a "how much debt is too much" test case. Strangely, Japan does not look so bad these days when compared to the US or Europe. Scarey to think that Japan has had a debt problem for decades and yet there is no end in sight. Hence the old saying "debt is not really a problem as long as someone is willing to fund it".

ReplyDeleteFor an interesting interactive on debt (government, household and financial) check out The Economist at

http://www.economist.com/blogs/graphicdetail/2012/09/daily-chart-10

Notice, that on household debt, Britain, Canada, and the US rank 1, 2, and 3. I find this particularly troublesome that Canadian household debt as a percentage of GDP is close to 90%.