For a good portion of the years since the Global Financial Crisis, Bank of Canada ("BOC") governor, Mark Carney, has attempted --through moral suasion-- to talk down the debt levels of those Canadians intent on buying homes, those renovating them, and those intent on keeping up appearances via conspicuous consumption in order to maintain a lifestyle akin to their seemingly affluent neighbours and friends. All to no avail: the BOC has known that the underlying economic strength of the macro economy --after glossing over the superficial GDP numbers that are forever subject to revision and drilling down to the real economy-- is weaker than at first blush. The path to so-called "rate normalization" touted in the investment community has not been forthcoming half way into 2012 and will not be (according to your humble scribe) as per the case that was made in a previous post and that unlike previous business cycles Canadians should brace for a new normal of low rates and lower than "trend" growth in economic activity.

One cannot overestimate the concern of household debt burden of Canadians in the context of the decisions of policy makers. Without fail, three of the BOC's periodicals: Bank of Canada Review; Financial System Review; and Monetary Policy Report have mentioned explicitly the concern surrounding household debt levels.

Canadian Household Finances and the Housing Market

The elevated level of household indebtedness continues to be the most important domestic risk to financial stability in Canada. There have been some welcome developments since the December FSR—notably, the pace of household debt accumulation has slowed and some vulnerability measures appear to be stabilizing. Nonetheless, vulnerabilities are entrenched for the most seriously at-risk households, and the Bank’s stress-test simulations continue to suggest that households are vulnerable to adverse economic shocks. Moreover, the continued high level of activity and stretched valuations in some segments of the housing market are of increasing concern. Overall, the Governing Council judges that the risks associated with high levels of household debt and a potential correction in the housing market are elevated and have not diminished since December. A reduction in this domestic risk requires a combination of deleveraging by vulnerable households and a reduction in housing market imbalances.

But at what point does the "combination of deleveraging by vulnerable households and a reduction in housing market imbalances" begin?

Where monetary policy has feared to tread at the risk of a hard landing, regulatory rules have stepped in and stepped up in the form of tougher mortgage rules and stricter oversight of the CMHC as set out by Finance Minister Jim Flaherty.

This is a welcome move but too late. The asset bubble that is residential real estate in Canada can best be seen through the Panglossian valuations in the Vancouver and Toronto markets.

A hat tip to the excellent Irish economist and 2011 INET grant recipient Stephen Kinsella who provided the inspiration to consider real estate appreciation within the framework of traditional asset price appreciation and has framed the business cycle as being intertwined with the housing cycle.

Where do Vancouver...

....and Toronto...

fit in as per the cycle. Is it truly "location, location, location?"

An unscientific sampling of house prices (Source: Globe & Mail Real Estate Section) in Toronto neighbourhoods over various time spans. Note how the often parabolic rise in house prices is the result of mortgage financing growth; whose salaries (in a sample of median wage earners) is rising at such rates?

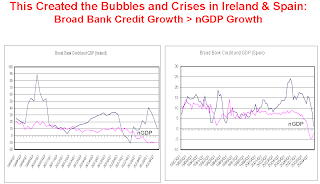

A rising tide lifts all boats, particularly when the great driver of housing prices in the willingness of financial institutions to lend: it is credit creation that has driven up real estate globally and the creation of credit is the purview of the commercial and shadow banking sector ("endogenous") rather than the central bank ("exogenous").

At the risk of intolerant scepticism and pithy comments concerning "Banking Mysticism" as stated by a notable New York Times columnist earlier this year, in the real world banks are not reserve constrained (as the orthodox textbooks are wont to tell you) as they are constrained by the risk tolerance, expectation of profit and quality of capital of the said lending institution. The money multiplier, as described by radical (tongue firmly-in-cheek) economists Seth B. Carpenter and Selva Demiralp in their empirical paper "Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?" and by BIS and Bank of Thailand economist Piti Disytat in his paper "Monetary policy implementation: Misconceptions and their consequences" is at best completely misunderstood.

While being highly intuitive, the utilization of the money multiplier in expositions of monetary transmission can be misleading.... From a monetary policy implementation perspective, however, the problem is in assumption (i) {(i) being binding reserve requirements limit the issuance of bank demand deposits to the availability of reserves)}. This is premised on the notion that central banks set the level of reserves as the operational target of policy and that banks’ deposit base, and thus their supply of loanable funds, is linked directly to variations in reserves through the money multiplier mechanism. In fact, the true causal relationship actually runs in exactly the opposite direction. The banking system creates deposits as they are demanded by the private sector, and the central bank’s main liquidity management task is to ensure a sufficient supply of balances for the system as a whole to maintain reserve requirements, if any, associated with those deposits. It is the amount of deposits that the banking sector can attract that determines the level of reserves not the other way around.Richard Werner, Chair in International Banking at Southampton Management School describes the role of credit (productive vs. consumptive) in encouraging asset bubbles as opposed to the productive capacity of a nation's real economy in this presentation from the April Just Banking Conference at Edinburgh Business School.

[Bold emphasis mine and inserted for context; excerpts from pp. 14-15, BIS Working Paper No. 269, (Disytat, 2008)]

The salient slides are shown below:

No comments:

Post a Comment