You can read John Hussman's full post here.

Hussman writes:

There is a dynamic to capitalism that makes it enduring but it requires checks and balances between all sectors of the economy. If the corporate sector continues to flourish at the expense of the household sector there comes a point where the demand will either drop off or stagnate. Corporate cost cutting can only go so far, as can extension of credit to the household sector to bring forward consumption.

This dynamic was foreshadowed in 1987 by Paul Sweezy and Harry Magdoff but muffled by a media that believes a truly dissenting view to be career ending.

Buoyant equity returns can continue but in 2015 they will climb the proverbial wall of worry.

It dovetails on my previous post about stock market returns and how they are guided by macroeconomic factors.

Hussman writes:

To see what’s going on, we can exploit the savings-investment identity

Investment = Savings

Investment = Household Savings + Government Savings + Corporate Savings + Foreign Savings (the inverse of the current account)

Corporate Profits = (Investment – Foreign Savings) – Household Savings – Government Savings + Dividends

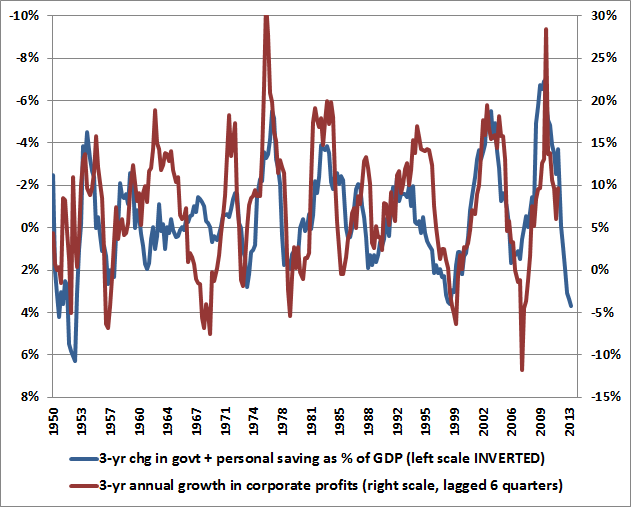

This basic decomposition, at least to an approximation allowed by national income accounting and modest statistical discrepancies, is shown below (h/t Jesse Livermore, Michal Kalecki).

|

| "Corporate profits as share of GDP nearly the mirror image of deficits in household and government sectors." |

We can go further. The reason (Investment – Foreign Savings) are in parentheses above is because particularly in U.S. data, they have an inverse relationship, as “improvements” in the current account are generally associated with a deterioration in gross domestic investment. So the term in parentheses adds very little variability over the course of the business cycle. Likewise, dividends are fairly smooth, and add very little variability over the course of the business cycle.

As a result, the above identity reduces – from the standpoint of overall variability – to a statement that corporate profits as a share of GDP are nearly the mirror image of deficits in the household and government sectors. A simple way to think about this is that dissaving in both sectors helps to support corporate revenues and limit the need for competition, even when wages and salaries are depressed. It follows that most of the variability in corporate profits over time is driven by mirror image variations in the household and government sectors. As it happens, this relationship turns out to be strongest with a lag of roughly 4-6 quarters. Given the general improvement in combined government and household savings that began just over a year ago, it follows that current-year or even higher year-ahead earnings estimates may not be particularly useful “sufficient statistics” for the purpose of valuing equities.

A predictable response among investors is to immediately seek alternate explanations that might allow profit margins to remain permanently elevated. First among these is the argument that somehow the production of U.S. companies abroad is not being taken into account. But the difference between Gross National Product (which does exactly that) and Gross Domestic Product – even if it represented pure profit – is only about 1%. The adjustment might make a difference in Ireland, where the gap between GNP and GDP is far larger, but the effect is purely second-order in the United States. Moreover, any additional dynamic that prompts the claim “this time is different” had better be one that emerged in the past few years, because as the charts above demonstrate, the mirror-image relationship between variations in corporate profits and variations in combined government and household savings has hardly missed a beat in the past century.GMO analyst and portfolio manager James Montier had a nice (once again referencing Michal Kalecki) write up related to corporate profits last year.

There is a dynamic to capitalism that makes it enduring but it requires checks and balances between all sectors of the economy. If the corporate sector continues to flourish at the expense of the household sector there comes a point where the demand will either drop off or stagnate. Corporate cost cutting can only go so far, as can extension of credit to the household sector to bring forward consumption.

This dynamic was foreshadowed in 1987 by Paul Sweezy and Harry Magdoff but muffled by a media that believes a truly dissenting view to be career ending.

To a free market economist, the rise of Wall Street was a natural outgrowth of the U.S. economy's competitive advantage in the sector. Sweezy said it reflected an increasingly desperate effort to head off economic stagnation. With wages growing slowly, if at all, and with investment opportunities insufficient to soak up all the [actual and potential] profits that corporation were generating, the issuance of debt and the incessant creation of new objects of financial speculation were necessary to jeep spending growing. "Is the casino society a significant drag on economic growth?" Sweezy asked in a 1987 article he cowrote with Harry Magdoff. "Again, absolutely not. What growth the economy has experienced in recent years, apart from that attributable to an unprecedented peacetime military build-up, had been almost entirely due to the financial explosion." ~Wiliam Hinton, The Great Reversal (New York: Monthly Review Press, 1990), 168-71 (emphasis added)

Buoyant equity returns can continue but in 2015 they will climb the proverbial wall of worry.

No comments:

Post a Comment